Coinbase Review 2025: What UK Traders Need to Know

How We Test & Review

At b3i.tech, we maintain rigorous standards for all blockchain and cryptocurrency content through comprehensive testing and verification.

Our Process

- Direct platform testing with real accounts and transactions

- Cross-referencing with blockchain explorers and on-chain data

- Review by experienced blockchain professionals

- Regular content updates to reflect market changes

Verification Standards

- All claims backed by multiple authoritative sources

- Technical accuracy verified through hands-on testing

- Clear disclosure of any affiliate relationships

- Independence maintained in all editorial decisions

Report inaccuracies: contact@b3i.tech

Last reviewed: November 7, 2025

Important Disclaimer

Educational Content Only

All content on b3i.tech is for educational and informational purposes. This is not financial, investment, or trading advice.

No Professional Advice

We are not licensed financial advisors. Always consult qualified professionals before making investment decisions.

Cryptocurrency Risks

Cryptocurrency investing carries significant risks including potential total loss of investment. Values are highly volatile and past performance doesn't guarantee future results.

No Guarantees

While we strive for accuracy, information may become outdated. We make no warranties about completeness, accuracy, or reliability of content.

Affiliate Disclosure

Some links may be affiliate links. We may earn commissions at no cost to you. This doesn't influence our editorial independence.

Your Responsibility

Any action you take based on this information is at your own risk. You're responsible for your own investment decisions and compliance with local laws.

Questions: contact@b3i.tech

Last updated: February 2025

Generating...

Jerry Dennis

Jerry DennisFounder & Lead Blockchain Strategist

Jerry Dennis is a visionary founder bridging traditional technology and decentralized finance. With over 15 years in software development and SaaS innovation, he brings deep expertise in creating scalable blockchain solutions and crypto-investment strategies. His passion lies in demystifying complex concepts and making advanced technology accessible.

Samantha Lee

Samantha LeeCo-founder & Chief Technology Officer

Co-founding b3i.tech alongside Jerry, Samantha Lee serves as the architect of the platform's security infrastructure. Her expertise in software engineering and cybersecurity ensures every digital transaction is handled with maximum safety and efficiency. She believes the future of decentralized technology must be inherently trustworthy and secure.

Markus Webb

Markus WebbHead of Research & Development

Markus Webb brings over a decade of experience in blockchain technology and digital currency research. He specializes in turning complex cryptographic concepts into practical financial solutions. His work focuses on analyzing blockchain applications and understanding the implications of cryptocurrency investments for the future of economic systems.

Quick Verdict: Is Coinbase Worth it?

Coinbase earns 4.3 out of 5 stars. It’s one of the easiest ways to buy crypto if you’re just starting out, though you’ll pay more in fees than competitors charge. The platform gives you access to 250+ cryptocurrencies, strong security measures, and instant withdrawals. If you trade often or move large amounts, those fees add up fast.

In this review, we’ll break down what Coinbase does well, where it falls short, and whether it’s the right fit for UK traders.

Coinbase Quick Stats

| Founded: | 2012 |

| Users: | 100+ million |

| Cryptocurrencies: | 250+ |

| Minimum Trade: | £2 |

| Trading Fees: | 1.5% – 4% |

| UK Regulation: | FCA registered |

| GBP Deposits: | Free (instant) |

What Is Coinbase?

Coinbase launched in 2012 when Bitcoin traded at just £5. Today it’s the largest U.S.-based crypto exchange with over 100 million registered users worldwide. The company trades publicly on NASDAQ, which means it follows strict financial regulations.

You can buy, sell, and trade more than 250 different cryptocurrencies through their platform. They offer two main trading interfaces: a simple version for beginners and an advanced version for experienced traders. Both share the same account, so you can switch between them anytime.

The platform works through a website or mobile app. You link a UK bank account or debit card, verify your identity, and start trading. Minimum trades start at just £2, though you’ll pay a £1 fee on amounts that small.

Is Coinbase Available in the UK?

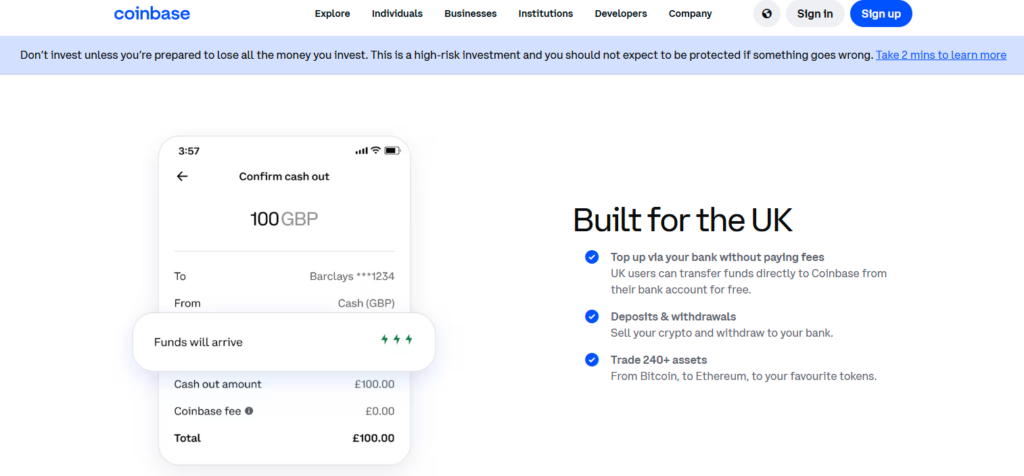

Yes. Coinbase is registered with the Financial Conduct Authority as a crypto asset firm. UK users can deposit pounds via Faster Payments, which arrive instantly and cost nothing. Withdrawals back to your UK bank account take 1-3 working days.

The platform supports GBP trading pairs for major cryptocurrencies. You can buy Bitcoin with pounds directly, without converting to dollars first. This saves you from currency exchange fees.

How Much Does Coinbase Actually Cost?

Coinbase fees confuse most people, and for good reason. The platform charges multiple types of fees that vary based on how you pay, how much you buy, and which version of Coinbase you use.

What Are the Main Fees?

Every trade includes two separate charges:

Spread: About 0.5% on top of the market price. Coinbase keeps this difference.

Transaction fee: Ranges from 1.5% to 4% depending on your payment method and purchase amount. Debit cards cost more than bank transfers.

When we bought £200 of Bitcoin using a UK bank account, the total fee came to £3.74 (1.87%). The same purchase with a debit card cost £8.38 (4.2%). You don’t see these exact percentages until the final checkout screen.

How Do Coinbase Advanced Fees Compare?

Coinbase Advanced uses a maker-taker fee structure. If you place an order that executes immediately, you’re a “taker” and pay higher fees. If your order waits in the order book, you’re a “maker” and pay less.

| Monthly Volume | Maker Fee | Taker Fee |

|---|---|---|

| Up to £750 | 0.60% | 1.2% |

| £750 – £7,500 | 0.35% | 0.75% |

| £7,500 – £37,500 | 0.25% | 0.40% |

| £37,500 – £375,000 | 0.15% | 0.25% |

| £375,000+ | 0.10% | 0.20% |

Fees drop as your trading volume increases. Your tier updates every hour based on your last 30 days of trades.

How Do Coinbase Fees Compare to Other UK Exchanges?

| Exchange | Trading Fees | Minimum Trade | Best For |

|---|---|---|---|

| Coinbase | 0.5% spread + 1.5-4% | £2 | Beginners |

| Kraken | 0.16% – 0.26% | £8 | Lower fees |

| Crypto.com | 0.075% – 0.40% | £1 | Low fees + card |

| eToro | 1% spread | £10 | Social trading |

Coinbase charges more than most competitors. If you trade weekly or deal with amounts over £1,000, you’ll save money elsewhere.

Is Coinbase Safe for UK Users?

Coinbase takes security seriously and has never been hacked. Here’s what protects your account:

Cold storage: 98% of customer funds sit in offline wallets that hackers can’t reach.

Insurance: Coinbase carries crime insurance that covers breaches in their systems (but not if someone steals your password). Note that crypto assets aren’t protected by the Financial Services Compensation Scheme.

Two-factor authentication: Required for all accounts. You can use SMS codes, an authenticator app, or a hardware security key.

Withdrawal delays: New payment methods trigger a waiting period before you can withdraw. This stops thieves who gain account access.

Who Regulates Coinbase in the UK?

The Financial Conduct Authority registers Coinbase as a crypto asset business. This means they follow UK anti-money laundering rules and maintain proper customer identification procedures.

Coinbase doesn’t hold a full FCA authorisation for investment services. They’re registered under the Money Laundering Regulations 2017. Your crypto holdings aren’t covered by FSCS protection if Coinbase fails.

The company also holds licences from regulators in Europe (MiCA), Germany (BaFin), and Ireland (Central Bank). Their U.S. operations are overseen by the SEC.

What Did We Find During Testing?

We opened a UK account and ran several tests. Login required both a password and a code from our authenticator app. Email alerts arrived within seconds whenever we signed in from a new device.

We deposited £100 via Faster Payments from Barclays. The money showed up in our account within minutes, no fees charged. We then withdrew Bitcoin to an external wallet. The transaction completed in under 10 minutes with no delays or verification steps beyond our normal 2FA.

How Easy Is It to Open a Coinbase Account?

Account setup takes about 10 minutes. You’ll need:

• A valid email address

• UK mobile number for SMS verification

• Government-issued photo ID (passport or driving licence)

• Proof of address (sometimes required)

The platform asks basic questions about your trading experience and income source. This is standard for financial services and required by UK law.

Photo ID verification happens through your phone camera. You’ll take a selfie and pictures of your ID. Most approvals happen instantly, though some accounts need manual review that takes a few hours.

What’s the Interface Like?

The main Coinbase dashboard shows your portfolio balance at the top in pounds, followed by a list of all available cryptocurrencies. Click any coin to see a price chart and buy/sell buttons. The whole process takes three clicks: select coin, enter amount, confirm purchase.

Prices display in GBP by default for UK accounts. You can switch to USD or EUR if needed. The charts show price movements in your chosen currency.

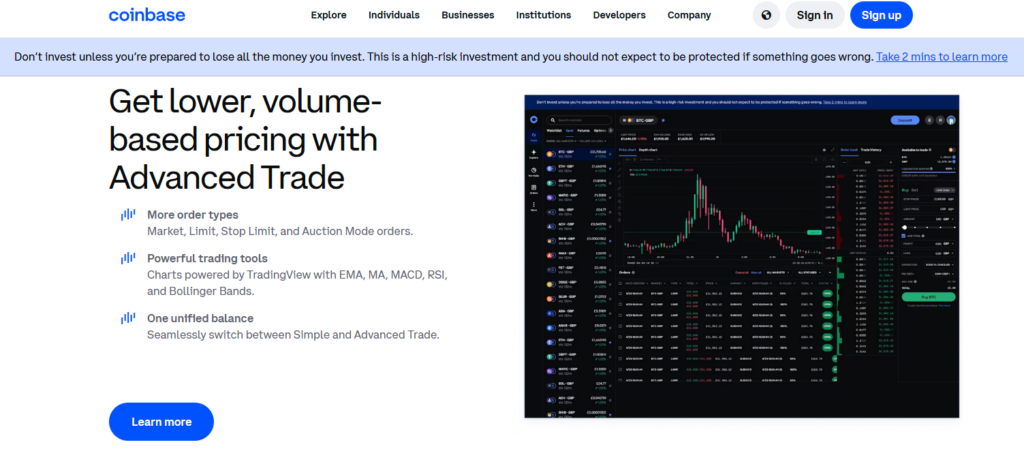

Coinbase Advanced looks more like a stock trading platform. You get candlestick charts, order books, and multiple order types (market, limit, stop). The interface packs in more information but stays organised. A dropdown menu lets you switch between simple and advanced views instantly.

The mobile app matches the website’s features. We found it slightly easier to use than the desktop version for quick trades.

How Long Do Deposits and Withdrawals Take?

UK bank transfers via Faster Payments arrive instantly and cost nothing. Debit card purchases go through immediately but carry higher fees. SEPA transfers from European banks take 1-3 working days.

Crypto withdrawals to external wallets process within minutes once you confirm via 2FA. You can withdraw crypto immediately after buying it, unlike many exchanges that make you wait for bank payments to clear.

Cash withdrawals to your UK bank account take 1-3 working days for standard transfers. The platform doesn’t currently offer instant cashout to UK debit cards (this feature is U.S.-only).

How Easy Is It to Open a Coinbase Account?

Account setup takes about 10 minutes. You’ll need:

• A valid email address

• UK mobile number for SMS verification

• Government-issued photo ID (passport or driving licence)

• Proof of address (sometimes required)

The platform asks basic questions about your trading experience and income source. This is standard for financial services and required by UK law.

Photo ID verification happens through your phone camera. You’ll take a selfie and pictures of your ID. Most approvals happen instantly, though some accounts need manual review that takes a few hours.

What’s the Interface Like?

The main Coinbase dashboard shows your portfolio balance at the top in pounds, followed by a list of all available cryptocurrencies. Click any coin to see a price chart and buy/sell buttons. The whole process takes three clicks: select coin, enter amount, confirm purchase.

Prices display in GBP by default for UK accounts. You can switch to USD or EUR if needed. The charts show price movements in your chosen currency.

Coinbase Advanced looks more like a stock trading platform. You get candlestick charts, order books, and multiple order types (market, limit, stop). The interface packs in more information but stays organised. A dropdown menu lets you switch between simple and advanced views instantly.

The mobile app matches the website’s features. We found it slightly easier to use than the desktop version for quick trades.

How Long Do Deposits and Withdrawals Take?

UK bank transfers via Faster Payments arrive instantly and cost nothing. Debit card purchases go through immediately but carry higher fees. SEPA transfers from European banks take 1-3 working days.

Crypto withdrawals to external wallets process within minutes once you confirm via 2FA. You can withdraw crypto immediately after buying it, unlike many exchanges that make you wait for bank payments to clear.

Cash withdrawals to your UK bank account take 1-3 working days for standard transfers. The platform doesn’t currently offer instant cashout to UK debit cards (this feature is U.S.-only).

How Many Cryptocurrencies Can You Trade?

Coinbase lists over 250 cryptocurrencies. This includes major coins like Bitcoin, Ethereum, and XRP, plus smaller altcoins and new projects. The selection changes regularly as Coinbase adds trending coins and removes ones that don’t meet their standards.

You can trade over 350 different crypto-to-crypto pairs. Want to swap Ethereum for Cardano directly? You can do that without converting to pounds first.

Popular GBP trading pairs include BTC/GBP, ETH/GBP, XRP/GBP, and ADA/GBP. This means you buy and sell directly in pounds without currency conversion costs.

How Does Staking Work?

Staking lets you earn rewards on certain cryptocurrencies just for holding them. Coinbase handles the technical side automatically. Available coins include Ethereum, Solana, Cardano, and Cosmos.

Rewards vary by coin and market conditions. Ethereum currently pays around 3% annually, whilst Solana offers closer to 5%. Coinbase takes a 15-35% cut of staking rewards, so you earn less than staking directly.

Your staked coins stay liquid on Ethereum, meaning you can sell or transfer them anytime. Other coins may have unbonding periods of several days.

Note: Staking rewards count as taxable income in the UK. You’ll need to report this to HMRC on your self-assessment return.

What’s the Learn & Earn Programme?

Coinbase pays you small amounts of crypto (usually £3-5 worth) for watching short educational videos and answering quiz questions. Available courses cover different blockchain projects and how they work.

You earn the actual cryptocurrency being discussed. Complete a lesson on Stellar, get £3 in Stellar. These rewards go straight into your Coinbase account. It’s a decent way to explore new coins without risking your own money.

Is Coinbase One Worth the Subscription Cost?

Coinbase One is a paid subscription that removes trading fees and boosts staking rewards. Three tiers are available:

Basic: £4.99/month (£49.99/year)

Zero trading fees on first £400 per month

Preferred: £29.99/month (£299.88/year)

Zero fees on first £7,500 per month

Premium: £299.99/month

Zero fees on first £75,000 per month

All tiers include priority customer support and higher staking returns. The Basic tier only makes sense if you trade more than £100/month (where you’d save more than £4.99 in fees).

Does the Subscription Actually Save Money?

Let’s say you trade £1,000 per month using a bank transfer. At standard Coinbase fees (roughly 2%), you’d pay £20 in fees. The Preferred subscription costs £30/month but saves you £20, so you’d still lose £10.

The maths works better for larger traders. Someone trading £5,000/month would pay about £100 in standard fees but only £30 for Preferred, saving £70/month. You need to trade at least £1,500-2,000 monthly for Basic to pay for itself.

Can You Actually Reach Coinbase Support?

Coinbase claims 24/7 support via phone, email, and chat. In practice, getting help from a real person takes work.

The app routes most questions to an automated chatbot first. We clicked through several menus before finding an option to email support. The platform doesn’t show a phone number unless you report a compromised account.

Our email got a response within 18 hours. The reply answered our question but came from an automated system, not a person. A second email asking for clarification got a human response two days later.

Coinbase’s help centre includes detailed articles about common problems. These proved more useful than waiting for support responses. The articles cover UK-specific topics like HMRC reporting and Faster Payments deposits.

What About Tax on Coinbase?

HMRC treats cryptocurrency as property, not currency. This means you’ll pay Capital Gains Tax when you sell crypto for a profit.

Every UK taxpayer gets a £3,000 Capital Gains Tax allowance (as of 2024/25 tax year). Profits below this are tax-free. Above this, you’ll pay 10% or 20% CGT depending on your income tax band.

Coinbase doesn’t report your trades to HMRC automatically, but HMRC can request your trading history if they investigate. Keep records of all your transactions.

You’ll need to report crypto gains on your Self Assessment tax return. Coinbase provides a transaction history export that makes this easier. Download it as a CSV file and either process it yourself or give it to your accountant.

How Does Coinbase Compare to UK Alternatives?

| Feature | Coinbase | Kraken | eToro |

|---|---|---|---|

| Ease of Use | Excellent | Moderate | Good |

| Trading Fees | 1.5-4% | 0.16-0.26% | 1% |

| Cryptocurrencies | 250+ | 200+ | 70+ |

| FCA Registered | Yes | Yes | Yes (authorised) |

| GBP Deposits | Free (Faster Payments) | Free (Faster Payments) | Free |

| Mobile App | Excellent | Good | Excellent |

What Does Coinbase Do Better Than UK Competitors?

The interface beats everyone else for simplicity. New users figure out how to buy crypto in minutes, not hours. The huge selection of 250+ coins means you can explore new projects without opening accounts at multiple exchanges.

Instant deposits via Faster Payments work brilliantly. Your pounds arrive in seconds, not days. This matches eToro but beats international exchanges that rely on slower SEPA transfers.

Where Do Other UK Exchanges Win?

Kraken crushes Coinbase on fees. Active traders save hundreds or thousands per year by switching. Their advanced charting tools and order types give you more control over trades.

eToro offers a more social experience with copy trading features. You can follow successful traders and automatically copy their moves. They’re also FCA authorised (not just registered), which some users prefer.

What Are the Pros and Cons?

| Pros | Cons |

|---|---|

| Very easy to use for beginners | Higher fees than most competitors |

| 250+ cryptocurrencies available | Fee structure confuses many users |

| FCA registered and regulated | Customer support hard to reach |

| Free instant deposits via Faster Payments | No FSCS protection on crypto |

| Trades start at just £2 | No demo account for practice |

| GBP trading pairs available | Coinbase One subscriptions expensive |

| Learn & Earn programme pays you | Tax reporting requires manual work |

Who Should Use Coinbase?

Best For:

First-time crypto buyers: The simple interface and educational content make learning easy. You can start with just £2 to test the platform.

Casual investors: If you buy crypto monthly or less often, the convenience outweighs the higher fees. You’re not trading enough for fees to matter much.

People who value regulation: FCA registration and strong security measures give you more protection than many alternatives.

Mobile traders: The app works better than most competitors’ apps. You can manage everything from your phone.

UK bank account holders: Faster Payments deposits are instant and free. This makes topping up your account dead easy.

Not Ideal For:

Active traders: Fees eat into your profits quickly. Platforms like Kraken or Crypto.com save you serious money.

Large volume traders: Even Coinbase Advanced fees run higher than competitors at similar volumes. You’ll pay thousands in unnecessary fees over time.

People who need phone support: Getting a human on the phone is nearly impossible. If that matters to you, look elsewhere.

Tax-averse users: Coinbase doesn’t generate UK tax reports automatically. You’ll need to process your transaction history yourself or pay an accountant.

Should You Use Coinbase?

Coinbase works great if you’re starting out with crypto or trade occasionally. The platform handles the basics well: easy account setup, strong security, and a clean interface. You’ll pay more than you would at Kraken or Crypto.com, but you get a much smoother experience.

The fees become a real problem if you trade often or move large amounts. At that point, the extra cost outweighs the convenience. Active traders should look at Coinbase Advanced or switch to a cheaper exchange entirely.

UK users benefit from instant Faster Payments deposits and GBP trading pairs. This makes Coinbase more attractive for British traders than it is for users in some other countries. You’re not losing money on currency conversions every time you deposit or withdraw.

Security and regulation set Coinbase apart from smaller exchanges. The FCA registration, cold storage, and public company oversight give you protections that many competitors don’t offer. This matters more than fees if you plan to hold significant amounts on the exchange.

We rate Coinbase 4.3 out of 5 stars. It loses points for high fees and poor customer support. It earns points for ease of use, security, and instant UK deposits. For most beginners, it’s still the best starting point.

FAQs

Is Coinbase registered in the UK?

Yes, Coinbase is fully registered with the Financial Conduct Authority (FCA) in the UK, which means it operates under strict compliance and client fund protection standards.

How much are Coinbase’s trading fees in 2025?

Standard Coinbase trades include a spread of around 1%, while Coinbase Advanced uses a maker/taker fee model starting at 0.6%/0.4%, with lower rates for high-volume users.

Can I stake crypto on Coinbase?

Yes, you can stake assets like Ethereum (ETH), Cardano (ADA), and Solana (SOL) directly through the platform. Coinbase takes a small commission on staking rewards.

Is Coinbase good for beginners?

Absolutely. Coinbase is widely considered one of the most beginner-friendly crypto exchanges, with a clean interface, educational tools, and simple buying workflows.

Does Coinbase support GBP deposits and withdrawals?

Yes, UK users can deposit and withdraw GBP via Faster Payments. The platform also supports PayPal and debit card purchases for added convenience.

References

App Store & Trustpilot Insights – Coinbase Reviews

MiCA Compliance Overview – Regulation of Markets in Crypto‑Assets (MiCA)

Insurance & Security Whitepaper – Digital Asset Insurance and Security Practices

Official Coinbase Fee Schedule – Pricing and Fees

Custody Solutions Comparison – Institutional Crypto Custody: Best Practices

Low Fees, Pro Trading

- Low Trading Fees

- Advanced Trading Tools

- FCA-Registered

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.