Is Coinbase Safe? Security & Regulation Explained (2025)

With a background in software engineering and specialized expertise in cybersecurity, Samantha Lee co-founded b3i.tech alongside Jerry. She has been instrumental in developing robust blockchain architectures that prioritize security and efficiency.

Jerry Dennis is a pioneering figure in the blockchain and SaaS sectors, known for his visionary approach and transformative strategies. With over 15 years of experience in software development and technology innovation, Jerry has played a pivotal role in multiple successful startups before diving into the world of blockchain. His expertise spans from developing scalable solutions to advising on crypto-investment strategies.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Quick Answer:

Yes, Coinbase is considered one of the safest crypto exchanges in 2025. It’s fully regulated, uses advanced security like cold storage and 2FA, and is publicly listed. While it’s custodial, tools like Vault and Coinbase Wallet give users more control and protection.

When I first started using Coinbase, safety was my number one concern. I’d heard too many stories about hacks, exit scams, and people losing money because they didn’t understand how crypto custody worked. So before I funded my account, I dug into exactly how Coinbase handles user security, and I’ve kept a close eye on it ever since.

Update: Recent Coinbase Data Breach

ccording to official statements, a limited number of Coinbase accounts were affected by an exploit targeting a third-party service used in Coinbase’s email verification process. While Coinbase’s core infrastructure and cold storage systems remained uncompromised, some users reported unauthorised account access due to exposed credentials in phishing campaigns.

What Coinbase Did in Response:

Promptly notified affected users.

- Secured vulnerable systems and isolated the breach vector.

- Offered two years of free identity theft protection and credit monitoring for those impacted.

What This Means for You:

If you currently use Coinbase, it’s more important than ever to:

- Enable 2FA using an authenticator app (not SMS).

- Regularly update your passwords and avoid password reuse.

- Be cautious with phishing emails claiming to be from Coinbase.

While this breach is concerning, it also highlights the importance of practising good security hygiene on any platform.

How Does Coinbase Protect Your Crypto and Personal Data?

Coinbase stores around 98% of all customer funds in cold storage, meaning they’re kept completely offline and inaccessible to hackers. That’s industry-leading and exactly what I’m looking for in a crypto exchange.

On the personal account level, Coinbase uses a multi-layered security model. I’ve enabled two-factor authentication (2FA) through an authenticator app, which adds a second step after entering my password. They also support biometric logins via fingerprint or face ID, which is particularly handy when using the mobile app.

Another nice touch: you can whitelist specific withdrawal addresses, which means even if someone did compromise your login, they couldn’t just send your crypto anywhere. Coinbase also runs an ongoing bug bounty program — they pay ethical hackers to report vulnerabilities before they become real problems. And, of course, all communications and transactions are fully encrypted.

What Happens to Your Money If Something Goes Wrong?

Now, one common misconception I hear from new users is that all crypto stored on Coinbase is insured. That’s not entirely true. If you’re holding USD on the platform, it is FDIC-insured up to $250,000 through Coinbase’s custodial banking partners. But your crypto holdings themselves aren’t insured, and that’s standard across the industry.

That said, I do appreciate Coinbase’s transparency around how and where funds are held. They are clear about their custodial relationships and have a solid reputation when it comes to honouring reimbursements in the rare cases of breaches or bugs.

Personally, I always enable 2FA and use Vault for anything I’m not trading regularly. It adds that extra peace of mind — and it’s saved me from a few heart attacks over the years.

Is Coinbase a Regulated and Legitimate Exchange?

Before I trusted Coinbase with a single pound or satoshi, I wanted to know exactly how it was regulated. After all, crypto exchanges aren’t like traditional banks — they don’t come with the same built-in safety nets unless they’re properly registered and accountable. That’s where Coinbase really stood out for me.

What Licences and Oversight Does Coinbase Have?

Coinbase is one of the most heavily regulated crypto exchanges in the world. In the United States, it’s registered as a Money Services Business (MSB) with FinCEN, which means it’s subject to strict anti-money laundering (AML) and know-your-customer (KYC) rules. That’s already a good sign — but it goes much further.

In the UK, Coinbase is officially registered with the Financial Conduct Authority (FCA) as a cryptoasset business. It’s not covered by the FSCS (so you won’t get £85,000 back if the company fails), but it is expected to follow the UK’s AML framework — and the FCA doesn’t hand out those registrations lightly.

Across the EU, Coinbase is aligning with the new MiCA (Markets in Crypto-Assets) regulation. This gives users a much-needed legal framework and more protection when using crypto exchanges operating in Europe. In Australia, the platform is registered with AUSTRAC, meaning it’s also compliant with AML/CTF standards down under.

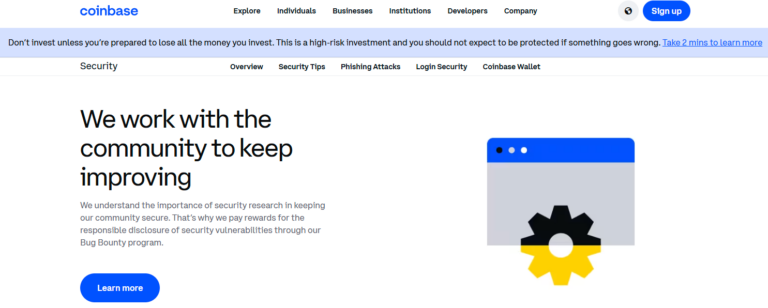

But what sealed the deal for me? Coinbase is publicly traded on the NASDAQ. That kind of transparency is rare in the crypto industry. As a listed company, they’re required to publish audited financials and file reports with the SEC. That makes shady business practices a lot harder to hide, which is good news for traders (like me) who use their platform.

What Are the Main Risks of Using Coinbase?

As much as I appreciate Coinbase’s security and regulation, I’m under no illusion that it’s risk-free. No crypto platform is. While I do use Coinbase regularly for trading and short-term holds, I’ve learned where the potential vulnerabilities lie—and how to manage them.

What’s more, the liquidity is deeper, and execution is noticeably quicker. You can see what the whales are doing, time your entries better, and generally just have more control over your trades.

Has Coinbase Ever Been Hacked?

Let’s start with the elephant in the room. Yes, Coinbase experienced a security incident back in 2021, when around 6,000 users were affected by a sophisticated SIM-swap attack. Hackers exploited SMS-based two-factor authentication to gain access to accounts. It’s important to note that this wasn’t a breach of Coinbase’s core infrastructure—the platform itself wasn’t hacked—but individual users were compromised through weak 2FA methods.

To their credit, Coinbase reimbursed the affected users and has since tightened account security significantly. These days, SMS-based 2FA isn’t even recommended. These days, serious users have now switched to authenticator apps or hardware keys, which are far more secure.

What Are the Ongoing Risks?

The biggest risk, in my opinion, is that Coinbase is a custodial platform, which means you don’t actually control your private keys. If something were to go wrong with Coinbase itself, or if your account was restricted, your access to your crypto could be temporarily (or permanently) affected.

And yes, Coinbase can freeze accounts—usually due to compliance checks, suspicious activity, or regulatory reasons. It hasn’t happened to me personally, but I’ve seen user reports where delays in verifying identity or clarifying transactions caused temporary issues.

Then there’s the regulatory side. Because Coinbase is based in the U.S., it’s heavily affected by American crypto policy. If you’re outside the U.S., this may feel a little disconnected, but it still has global implications. A crackdown by U.S. regulators can ripple across the platform.

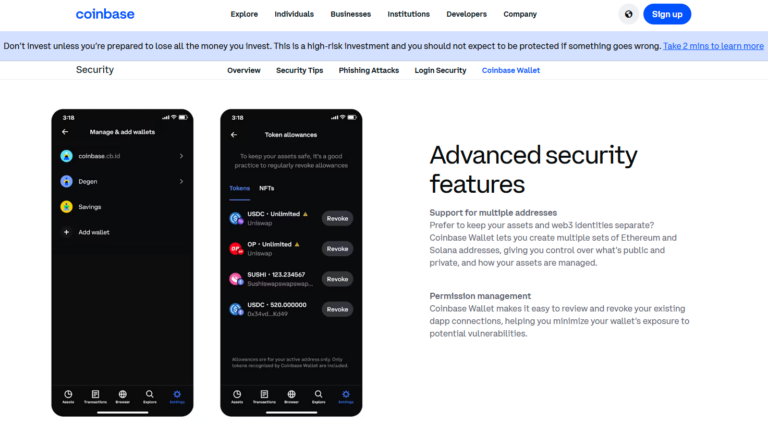

How Does Coinbase Wallet Compare?

If you’re looking for more control, Coinbase Wallet is a great non-custodial option. You hold your private keys, and no one—not even Coinbase—can touch your crypto. It’s ideal if you’re exploring DeFi protocols, NFTs, or planning to hold assets long-term.

That said, using a self-custody wallet means you’re responsible for everything. Lose your keys? There’s no password reset button. I use Coinbase Wallet for DeFi and small experiments, but I still keep most long-term holdings in a hardware wallet like Ledger.

TLDR? I trade on Coinbase but move larger amounts to a hardware wallet. Think of Coinbase like a checking account, not a vault. It’s convenient and secure for daily use, but not where I’d store a life-changing amount of crypto.

Should You Store Crypto on Coinbase Long-Term?

This is a question I get asked often, and the honest answer is—it depends on how you use it.

If you’re actively trading, or managing smaller balances, then keeping your assets on Coinbase can be perfectly reasonable. I do this myself for coins I trade regularly or plan to move in and out of short-term positions.

It’s also a good option for staking, particularly if you’re just starting out. Coinbase offers staking rewards on several coins, and the process is super user-friendly—no complex wallet setups or validators required.

When Should You Use an External Wallet?

That said, if you’re holding long-term, or managing a larger portfolio, I would definitely recommend moving funds to an external wallet—either something like Coinbase Wallet or a hardware wallet like Ledger or Trezor. It’s a much safer option for the long haul.

Also, if you’re planning to dive into DeFi or need to interact with Apps, then you’ll want a non-custodial wallet that gives you full control over your private keys and tokens.

How Does Coinbase Compare to Other Crypto Platforms?

Over the years, I’ve used just about every major crypto exchange. Each one has its strengths, and depending on what you’re looking for, you might find a better fit elsewhere. But when it comes to security, ease of use, and regulatory transparency, Coinbase still holds a strong position, especially for beginners and risk-conscious investors.

Compared to Binance, Coinbase is a breath of fresh air. Binance is packed with features—margin, futures, DeFi access—but the interface can feel overwhelming. I’ve introduced friends to both, and almost all of them stuck with Coinbase because it just felt easier.

With Kraken, the differences are more subtle. Kraken does have an edge on fees and advanced tools, but I find Coinbase’s staking and mobile experience more intuitive.

Then there’s eToro, which is great for copy trading and investing in both stocks and crypto. But its crypto offering is pretty limited.

One trading strategist I follow summed it up perfectly:

“With no subscription and access to real-time order books, Coinbase Advanced strikes a balance between transparency and performance — ideal for serious retail traders.”

And I agree entirely. You get fast execution, clear fees, and deep liquidity without being forced into a paid tier or gated system. It’s built in a way that supports your growth as a trader, whether you’re just moving beyond market orders or scaling up to higher volume strategies.

In my view, it’s this mix of accessibility and professionalism that makes Coinbase Advanced stand out. You don’t have to be a full-time professional to benefit, but it’s robust enough that even if you are, it holds up.

Who Is Coinbase Best For?

If you’re new to crypto, or in the market for a platform that’s trusted, regulated, and easy to navigate, Coinbase is probably your safest bet. I often recommend it to those just getting started—it’s not the cheapest or most feature-rich, but it’s reliable.

On the flip side, Coinbase isn’t ideal if you’re a seasoned trader or looking to dive deep into DeFi. You’ll find more flexibility (and lower fees) on other platforms or even a DEX if you’re ready for it.

TLDR: I often recommend Coinbase to friends new to crypto—it’s not perfect, but it’s safe and intuitive. And when you’re dealing with real money, that counts for a lot.

What Do Users and Experts Say About Coinbase’s Safety?

As someone who researches platforms before I commit, when it comes to Coinbase, the sentiment is fairly consistent: safe, but not without a few rough edges.

What about Real User Experiences?

Across sites like Trustpilot, Reddit, and the App Store, you’ll see a mixed bag. Most users (myself included) highlight how easy it is to get started. The interface is clean, the mobile app is reliable, and onboarding is smoother than most crypto platforms.

However, the most common complaints I’ve encountered—and occasionally experienced—are around slow customer support, particularly during market surges. Some users have also reported delayed withdrawals or frozen accounts, usually tied to verification issues or compliance reviews. It’s frustrating, but not uncommon across regulated platforms.

What Do Industry Experts Say?

From an industry standpoint, Coinbase is widely considered one of the safest centralised exchanges (CEXs) in the world. It ticks all the right boxes—regulation, transparency, and robust security protocols. The fact that it undergoes public audits and complies with financial oversight in multiple jurisdictions sets it apart from many offshore competitors.

That said, experts often note the limitations of custodial platforms—you don’t control your private keys, and your funds are subject to regulatory influence, especially in the U.S.

Final Verdict – Is Coinbase Safe to Use in 2025?

After using Coinbase for several years, I can confidently say it’s one of the safest crypto exchanges on the market.

It has the strongest regulatory footprint in the industry, from FinCEN and the FCA to compliance with MiCA and AUSTRAC. That gives me a lot more peace of mind compared to some of the alternatives I’ve tested. The security infrastructure is solid, too—cold storage, biometric login, 2FA, and features like Coinbase Vault all help reduce the risks of user error or external attack. And if you want more control, Coinbase Wallet gives you that flexibility.

Still, custodial risks are real. If Coinbase ever experienced a major failure or regulatory shutdown, users could face delays or restrictions. That’s why I always advocate for personal responsibility—learn how wallets work, and don’t leave more than you need to on any exchange. If you want peace of mind, Coinbase is among the safest exchanges. Just remember—it’s only as secure as your own setup. Use 2FA, understand custodial limitations, and consider a wallet if you’re in this for the long haul.

For me, the upgrade happened naturally. Once I started trading more frequently and wanted tighter control over my orders, the Basic interface just didn’t cut it anymore. With Advanced, I can plan trades, use limit and stop orders, and monitor real-time market data—all without leaving the Coinbase ecosystem I already trusted.

If you’ve outgrown the simplicity of Coinbase Basic but don’t want to dive into overly complex platforms, Coinbase Advanced hits that sweet spot. It gives you the tools to trade smarter, without asking you to pay more just to unlock them.

FAQs

Yes, Coinbase is highly secure and regulated, but it’s still a custodial platform. For large holdings, I recommend using Coinbase Vault or a hardware wallet for added control.

No, crypto assets aren’t insured. However, USD balances are covered up to $250,000 through custodial banks under FDIC-style insurance in the U.S.

Yes. Like most regulated exchanges, Coinbase can temporarily restrict access for compliance reasons or if suspicious activity is detected.

Coinbase Wallet is non-custodial, meaning you control your private keys. It offers more freedom but requires personal responsibility, especially for key storage and recovery.

Absolutely. Its intuitive design, strong compliance, and security tools make it one of the best platforms for newcomers to crypto.

References

- Coinbase – Security & Insurance FAQs

- Coinbase – Legal and Compliance Centre

- Coinbase UK – FCA Cryptoasset Business Register

- FinCEN – Money Services Business Registration

- EU Parliament – Markets in Crypto-Assets Regulation (MiCA) Overview

- Coinbase SIM-Swap Incident – Official Response (2021)

- Trustpilot – Coinbase Reviews

Low Fees, Pro Trading

- Low Trading Fees

- Advanced Trading Tools

- FCA-Regulated & Secure

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.