eToro Review 2025: Is It the right platform for you?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How We Test & Review

At b3i.tech, we maintain rigorous standards for all blockchain and cryptocurrency content through comprehensive testing and verification.

Our Process

- Direct platform testing with real accounts and transactions

- Cross-referencing with blockchain explorers and on-chain data

- Review by experienced blockchain professionals

- Regular content updates to reflect market changes

Verification Standards

- All claims backed by multiple authoritative sources

- Technical accuracy verified through hands-on testing

- Clear disclosure of any affiliate relationships

- Independence maintained in all editorial decisions

Report inaccuracies: contact@b3i.tech

Last reviewed:

Important Disclaimer

Educational Content Only

All content on b3i.tech is for educational and informational purposes. This is not financial, investment, or trading advice.

No Professional Advice

We are not licensed financial advisors. Always consult qualified professionals before making investment decisions.

Cryptocurrency Risks

Cryptocurrency investing carries significant risks including potential total loss of investment. Values are highly volatile and past performance doesn't guarantee future results.

No Guarantees

While we strive for accuracy, information may become outdated. We make no warranties about completeness, accuracy, or reliability of content.

Affiliate Disclosure

Some links may be affiliate links. We may earn commissions at no cost to you. This doesn't influence our editorial independence.

Your Responsibility

Any action you take based on this information is at your own risk. You're responsible for your own investment decisions and compliance with local laws.

Questions: contact@b3i.tech

Last updated: February 2025

Generating...

Jerry Dennis

Jerry DennisFounder & Lead Blockchain Strategist

Jerry Dennis is a visionary founder bridging traditional technology and decentralized finance. With over 15 years in software development and SaaS innovation, he brings deep expertise in creating scalable blockchain solutions and crypto-investment strategies. His passion lies in demystifying complex concepts and making advanced technology accessible.

Samantha Lee

Samantha LeeCo-founder & Chief Technology Officer

Co-founding b3i.tech alongside Jerry, Samantha Lee serves as the architect of the platform's security infrastructure. Her expertise in software engineering and cybersecurity ensures every digital transaction is handled with maximum safety and efficiency. She believes the future of decentralized technology must be inherently trustworthy and secure.

Markus Webb

Markus WebbHead of Research & Development

Markus Webb brings over a decade of experience in blockchain technology and digital currency research. He specializes in turning complex cryptographic concepts into practical financial solutions. His work focuses on analyzing blockchain applications and understanding the implications of cryptocurrency investments for the future of economic systems.

Quick Answer:

eToro remains a strong choice in 2025 for long-term investors and beginners. With zero-commission stock trading, CopyTrader™, Smart Portfolios, and solid regulation, it’s a user-friendly platform, though less suited to advanced traders who need pro-level tools.

From zero-commission stock trading and integrated crypto wallets to its Smart Portfolios and regulated global presence, eToro has definitely evolved. But has it kept up with investor expectations on costs, execution, and tools? That’s what I set out to answer in this review.

I’ve personally tested the platform this year — placing trades, copying investors, and poking around their staking and portfolio tools — so everything in this review is grounded in real use, not just theory. Let’s break it down:

Which authorities oversee eToro?

eToro is regulated in multiple jurisdictions, and that’s a big green flag in my book. In the UK, they’re authorised by the Financial Conduct Authority (FCA), which means you’re backed by some of the strictest financial standards in the world. If you’re in Europe, they’re covered by CySEC, and if you’re trading from Australia or the US, they’re regulated by ASIC and FinCEN, respectively.

What gives me even more confidence is that eToro is now publicly listed on the NASDAQ under the ticker ETOR. That means they’re required to publish audited financials, maintain transparency, and follow corporate governance rules — something you won’t get with smaller brokers.

Which authorities oversee eToro?

From what I’ve seen, eToro has solid systems in place. For UK-based investors, they offer FSCS protection up to £85,000, which is a huge plus. They also segregate client funds, meaning your money is kept separate from their operational accounts.

If you’re trading crypto, they use cold storage to hold digital assets securely offline. The platform is also protected by two-factor authentication (2FA) and encryption to safeguard your personal data.

Here’s a quick breakdown of how eToro stacks up:

From my experience, I’ve never had any concerns about safety on eToro — and the fact that they operate under multiple regulators gives me peace of mind when I trade or invest through the platform.

Are eToro’s Fees Competitive?

When I first started using eToro, one of the things that really drew me in was the promise of zero-commission trading. If you’re buying stocks or ETFs, you won’t pay a commission, which is great for long-term investors like me who like to build positions gradually without being hit by fees on every trade.

That said, there are other fees you need to be aware of. For starters, while stock and ETF trading is commission-free, crypto and CFD trades are spread-based, meaning the cost is baked into the difference between the buy and sell price. On major cryptos like Bitcoin, that spread can hover around 1%, but I’ve seen it higher during volatile periods.

Another key thing I’ve learned: eToro operates in USD only. So if you’re funding your account in CAD, EUR, or AUD, you’ll get hit with a 0.5% currency conversion fee. It doesn’t sound like much, but it adds up if you’re depositing larger amounts.

Withdrawals are straightforward — a $5 flat fee — and if you leave your account dormant for 12 months, there’s a $10/month inactivity charge.

What is the Cost impact on different strategies?

In my experience, long-term investors get the best deal here. If you’re investing in stocks, ETFs, or Smart Portfolios and holding for months or years, the fee structure is very manageable. I also like the passive income you can earn through crypto staking — something not all platforms offer.

But if you’re an active trader or someone who jumps in and out of positions regularly, spreads can eat into your profits quickly, especially on leveraged CFD trades.

TLDR? eToro isn’t the cheapest platform, but if you use it for longer-term investing, the costs are easy to live with.

What is the Platform Experience Like?

After years of testing different brokers, I can say that eToro delivers one of the cleanest and most intuitive user experiences out there, especially if you’re not a full-time day trader glued to technical charts. I’ve used both the desktop platform and mobile app extensively in 2025, and they’ve made big improvements in terms of speed and usability.

How is the User Interface and Tools?

The first thing that stood out to me was how user-friendly the dashboard is. You can easily switch between watchlists, portfolios, charts, and social feeds without feeling overwhelmed. Whether I’m casually checking my Smart Portfolios or actively managing positions, the layout just works — it feels natural.

For beginners or passive investors, it’s ideal. Everything is laid out clearly, and portfolio performance is tracked in real time. I also recommend the demo account, which gives you $100,000 in virtual funds to practice with. I used it myself when I first started to get a feel for the copy trading features and test a few ideas risk-free.

What about the Execution and Order Types?

Execution is perfectly fine for most retail trades, and I’ve never run into delays or failed orders. But if you’re trading fast-moving markets or relying on precision entries, eToro probably isn’t the sharpest tool in the shed.

Advanced order types are limited — no trailing stops, no bracket orders, and stop limits aren’t available on every asset. There’s also no MetaTrader support (MT4/MT5) and no access to custom APIs, which may be a dealbreaker if you’re an algorithmic or high-frequency trader.

What Education and Research tools does eToro Provide?

One of eToro’s signature features is their social feed, where users share market thoughts, analysis, and trade ideas. It’s great for picking up real-time sentiment, but I wouldn’t rely on it as your only research tool.

There’s also a learning hub with tutorials and market explainers — handy if you’re new to trading. But let’s be honest: it’s not exactly deep-dive material. If you’re an experienced investor looking for institutional-grade research, you’ll need to use third-party tools alongside eToro.

Can You Trust eToro’s CopyTrader™ and Smart Portfolios?

When I first discovered eToro, it was the CopyTrader™ feature that caught my attention. The idea of automatically mirroring the trades of top-performing investors sounded like a dream, especially when I was still figuring out my own strategy. Years later, I still think it’s one of the platform’s most unique selling points, though it’s not without its trade-offs.

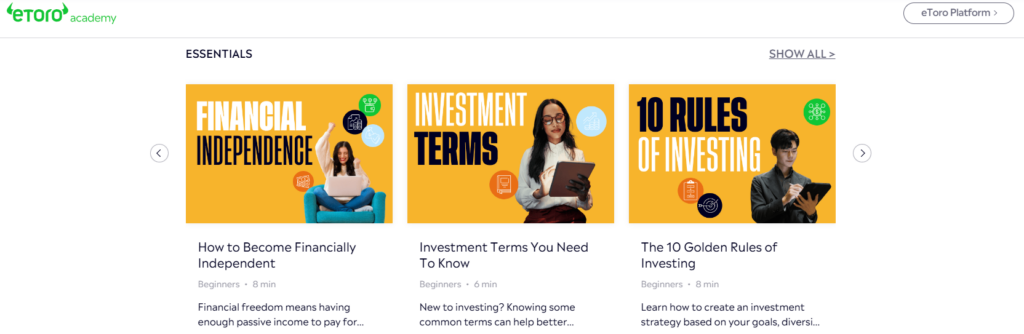

How does CopyTrader™ Work?

You pick a trader from eToro’s leaderboard, someone whose style and performance match what you’re after, set the amount you want to allocate (the minimum is $200), and from that point on, your account mirrors their trades automatically.

I’ve copied a few traders over the years, mostly to diversify my approach and see how others handle market volatility. What’s reassuring is that eToro provides a risk score, performance history, portfolio breakdown, and even stats on trade frequency and average hold time.

Is it effective for real diversification?

In my experience, CopyTrader™ can be a smart passive strategy, especially if you spread your capital across multiple traders with different styles. That said, it’s easy to fall into the trap of copying high-return profiles without considering the risk.

I’ve learned to pay close attention to drawdown history and avoid anyone trading with excessive leverage or a one-asset focus. Remember, past performance isn’t a guarantee of future success, and you should keep an eye out to manage your personal risk.

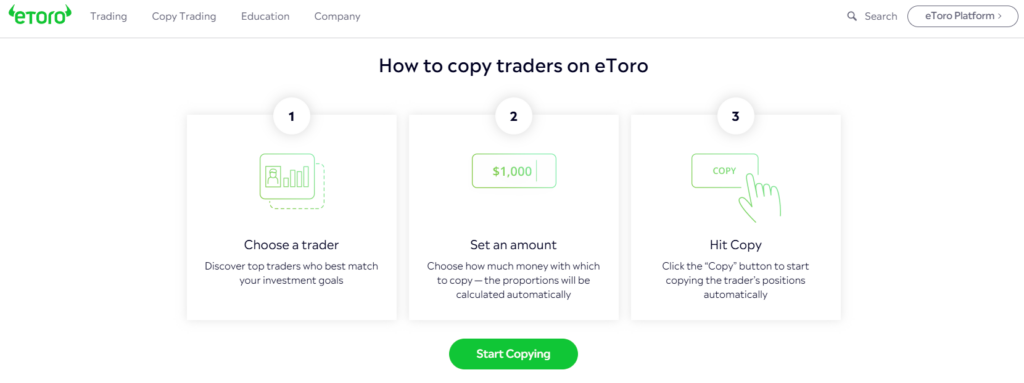

What are Smart Portfolios?

Smart Portfolios are thematically structured investment baskets managed by eToro’s investment team. They are rebalanced periodically but not actively traded like a mutual fund. You’ll find options covering AI, dividend stocks, green energy, crypto, and more. They are fully managed, which makes them great for hands-off investors.

I hold a couple of Smart Portfolios, one focused on blockchain, another on big tech and I like how they offer diversified exposure without micromanagement. Just bear in mind that your capital is still tied to the platform itself, so there’s some centralisation risk.

Who Should Use eToro?

If you’re a long-term equity investor or someone who is looking for global stock market access with low fees, eToro ticks a lot of boxes. With eToro you can build a solid, diversified portfolio of shares and ETFs without paying a single cent in commission. Add in fractional shares and Smart Portfolios, and you’ve got serious flexibility with how you allocate capital.

It’s also a solid choice for crypto investors or if you are in the market for a platform that keeps everything in one place. I use their integrated crypto wallet for transfers and hold some coins for staking and it’s all very smooth.

Where eToro really shines, though, is for passive investors who don’t want to spend hours researching markets. Between CopyTrader™ and the Smart Portfolio options, you can automate a good chunk of your investment strategy — just keep an eye on the fees and underlying risk.

Lastly, if regulation and ease of use matter to you, this is one of the more beginner-friendly platforms that still carries the credibility of a licensed broker.

Final Thoughts

After using eToro across different market conditions, I can say it delivers exactly what many self-directed and passive investors need: a simple, secure, and well-regulated platform with access to a wide range of assets. Whether you’re buying global stocks, holding crypto, or exploring Smart Portfolios, it’s all right there — and it’s incredibly easy to use.

However, if you’re a more advanced trader who relies on direct market access, complex order types, or deep technical tools, eToro will probably fall short. It’s also not built for tax-optimised investing in the UK, which is a real limitation if you’re looking to make the most of SIPPs.

That said, for what it’s designed to do — give you low-cost access to markets in an easy-to-use, regulated environment — eToro does a great job. I’d personally recommend it to anyone starting out, or to investors like me who want to automate part of their strategy using features like CopyTrader™ or Smart Portfolios.

If you are interested in trading with eToro I would suggest trying the demo, testing out CopyTrader™ to see how it fits with your goals. eToro won’t suit every trading strategy — but for the right investor, it’s a solid base to build on.

eToro is a multi-asset platform which offers both investing in stocks and

cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money

rapidly due to leverage. 61% of retail investor accounts lose money when

trading CFDs with this provider. You should consider whether you

understand how CFDs work, and whether you can afford to take the high risk

of losing your money.

This communication is intended for information and educational purposes

only and should not be considered investment advice or investment

recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your

investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a

high-risk investment and you should not expect to be protected if something

goes wrong.

eToro USA LLC does not offer CFDs and makes no representation and

assumes no liability as to the accuracy or completeness of the content of this

publication, which has been prepared by our partner utilizing publicly

available non-entity specific information about eToro.

FAQs

Yes — eToro is fully monitored by the Financial Conduct Authority (FCA). UK clients also benefit from FSCS protection up to £85,000.

No — eToro offers zero-commission trading on stocks and ETFs. However, spreads, conversion fees, and withdrawal charges may still apply.

Yes — eToro supports automated staking on select coins like ETH and ADA. Rewards are paid monthly, and eToro takes a commission for managing the process.

Absolutely. With its clean interface, demo account, CopyTrader™, and educational tools, eToro is one of the most beginner-friendly platforms available in 2025.

Yes — eToro provides downloadable tax reports and trade history statements in CSV or PDF format, which can be used for filing or with tax software.

References

- eToro – Regulation and License

- eToro – Granted MiCA Permit

- eToro – Fees Explained

- eToro – Staking Services

- eToro – Expands Crypto Staking Programme

- eToro – Tax Report Guide

Earn Up To $500 In Free Assets*

Tiered deposit bonus for new users

Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.