Kraken Review: My Professional Opinion

Markus Webb brings over a decade of experience in blockchain technology and digital currency research. His work focuses on the practical applications of blockchain to real-world financial solutions and the implications of cryptocurrency investments.

With a background in software engineering and specialized expertise in cybersecurity, Samantha Lee co-founded b3i.tech alongside Jerry. She has been instrumental in developing robust blockchain architectures that prioritize security and efficiency.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Quick Answer:

Kraken remains one of the most secure and reliable crypto exchanges in 2025. With low fees on Kraken Pro, strong regulatory oversight, and robust staking options, it’s ideal for serious investors and traders. However, beginners may find the interface less intuitive.

I’ve been using Kraken on and off since 2017, and in 2025, it still holds a spot in my portfolio of go-to exchanges. It’s not perfect, but it’s built a strong reputation for being one of the most secure and transparent crypto platforms in the industry, especially for serious traders and long-term investors.

In this review, I’ll walk you through everything you need to know about Kraken: it’s fee structure, supported coins, advanced trading tools, staking options, security measures, and how it compares to competitors.

What Makes Kraken a Trusted Name in Crypto?

Since Kraken began in 2011, it has had this no-nonsense, regulation-first approach that really sets it apart. If you’re after a platform that prioritises security and integrity over following flashy trends, then Kraken ticks a lot of boxes.

Kraken appeals most to long-term investors, active traders, and institutions looking for deep liquidity, transparent pricing, and a strong compliance record. I’ve used it for both casual buying and more complex trades, and it’s never once given me the kind of anxiety that I’ve felt with some of the newer platforms.

What makes Kraken different today is its continued focus on reliability over hype. While other exchanges chase trends—adding meme coins and yield farming features—Kraken has stayed grounded. That doesn’t mean it’s boring, though. You will get access to 200+ cryptocurrencies, futures, staking, and even an NFT marketplace (depending on your region).

What Are the Pros and Cons of Kraken?

After using Kraken for several years, I’ve got a pretty balanced view of what it does well and where it falls short. No platform is perfect, but Kraken’s strengths definitely outweigh its weaknesses if you know what you’re looking for.

How Secure and Regulated Is Kraken?

Kraken is one of the few exchanges that takes global compliance seriously. In the US, it’s registered with FinCEN as a money services business. If you’re in the UK, it operates under the oversight of the FCA, and in Australia, it’s registered with AUSTRAC. That level of global licensing is rare in crypto—and it shows that Kraken isn’t just catering to one market, but building a worldwide, regulation-compliant platform.

I’ve also noticed that Kraken is far more transparent than most. Its regular audits, clear terms of service, and robust internal compliance policies have always made me feel like they’re operating with integrity.

What Security Measures Protect Your Crypto?

From a user perspective, security starts the moment you log in. Two-factor authentication (2FA) is mandatory, and I highly recommend using an authenticator app instead of SMS. You can also enable withdrawal whitelisting, which restricts transfers to approved wallets—a feature I never trade without.

Behind the scenes, Kraken stores over 95% of all client funds in cold wallets, totally offline and out of reach of hackers. The exchange also runs internal audits and funds a bug bounty program that pays white-hat hackers to find vulnerabilities in their operational security.

Are Your Funds Insured on Kraken?

This is a common point of confusion. While your fiat deposits (like USD or GBP) held in custodial bank accounts may be insured, your cryptocurrency is not. That’s the norm across the industry, not a Kraken flaw; therefore, it’s something you should always factor into your risk management strategy.

What Can You Trade on Kraken?

Kraken supports 200+ cryptocurrencies, and that includes all the essentials like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cardano (ADA), XRP, Polkadot (DOT), and Avalanche (AVAX). You’ll also find a wide range of stablecoins (like USDT, USDC), DeFi tokens, and even some meme coins if that’s your thing.

I appreciate that Kraken doesn’t just list everything under the sun. It’s more selective, which tells me they’re thinking about long-term integrity rather than riding hype cycles. That said, if you’re chasing every new altcoin launch, other platforms might offer broader exposure.

Can You Trade with Leverage?

Yes, you can—but it depends on where you’re based. Kraken offers margin trading with up to 5x leverage on select pairs, though availability is limited in some regions due to regulations.

If you’re a more advanced trader (like me on certain days), you’ll probably be drawn to Kraken Futures. These contracts let you take long or short positions on crypto assets with leverage, and I’ve found the platform to be quite stable—even during market spikes.

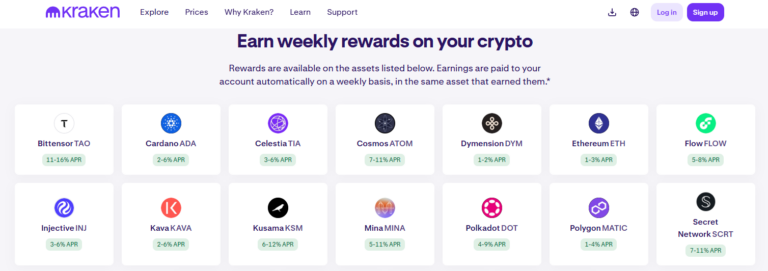

Does Kraken Support Staking or NFTs?

Absolutely. Kraken offers staking for over 20 assets, including ETH, DOT, ADA, ATOM, and SOL. I’ve used their staking feature for ETH and ATOM—it’s simple, flexible, and the rewards have been consistent.

As for NFTs, Kraken hosts a NFT marketplace, which has been gradually expanding. While I haven’t used it extensively, the interface is clean, and it supports zero gas fees—something that’s rare in the NFT world.

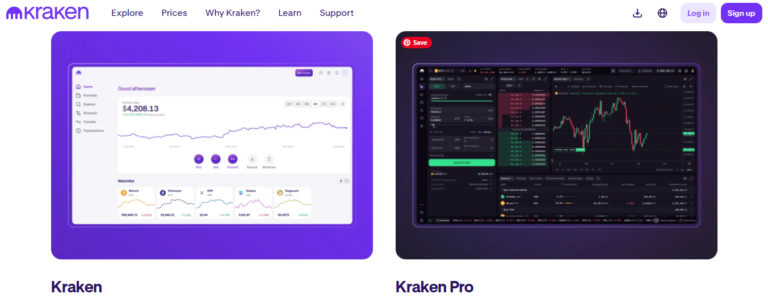

What Tools Does Kraken Pro Offer?

If you’re serious about trading, Kraken Pro is made with you in mind. The charting tools are top-notch, order types are flexible (market, limit, stop-loss, etc.), and the liquidity depth is excellent, even for larger trades.

I mostly use the desktop version for detailed analysis, but the mobile app is surprisingly robust. It’s not flashy, but it’s reliable, which matters more when real money’s on the line.

How Much Does Kraken Cost to Use?

If you’re using Instant Buy, you’ll pay roughly 1.5% per transaction. It’s designed for convenience, like if you want to grab some BTC or ETH quickly and move on.

Kraken Pro uses a maker-taker model, starting at 0.16% for makers and 0.26% for takers. The more you trade over a 30-day period, the lower your fees drop. For anyone placing regular orders, the savings are noticeable.

What Other Fees Should You Expect?

There are a few other charges to keep in mind. Crypto withdrawal fees vary by asset—Bitcoin is about 0.00015 BTC, and Ethereum’s usually a bit higher due to network costs. I’ve found these to be competitive with other major exchanges.

Fiat deposits and withdrawals (in USD, EUR, or GBP) can sometimes come with banking charges, depending on your method. I usually fund via bank transfer to keep costs low.

Lastly, if you’re funding in a currency different from your account’s base (say, sending GBP into a USD wallet), Kraken applies a 0.25% FX conversion fee. It’s fair, but something to be aware of if you’re trading across multiple fiat currencies.

How User-Friendly Is Kraken for Everyday Investors?

Kraken has come a long way in terms of usability, but I’ll be honest—it’s still not the most accessible exchange. That said, once you get used to it, it’s rock solid.

Signing up is fairly straightforward. I created my account years ago, but I’ve helped friends onboard recently, and the process hasn’t changed much. You’ll need to go through standard KYC verification—uploading your ID, proof of residence, and sometimes a short video of your face.

Approval usually happens within a few hours, though during market surges, it can take longer. Funding your account is easy via bank transfer, and you can deposit in multiple currencies (USD, GBP, EUR, etc.), which is a big plus.

Is Kraken’s Interface Easy to Navigate?

The platform splits into Kraken Basic and Kraken Pro. Basic is designed for quick buys and sells, and it’s okay if you’re just getting started.

Kraken Pro is where you’ll find a dashboard that gives you access to charts, depth books, order management, and basically everything you need to trade like a pro.

For new traders, Kraken also offers a solid Learn section with tutorials, videos, and blog articles. I’ve referred a few people there, and they’ve found it helpful.

How Responsive Is Kraken’s Customer Support?

Kraken offers 24/7 customer support through live chat, email support, and a well-organised self-help section. It has earned recognition as a Best Crypto Customer Support winner and maintains a large multilingual support team.

While many users report positive experiences, some independent reviews and surveys highlight issues like delayed responses during busy periods. Kraken’s Trustpilot rating reflects mixed feedback, but the platform continues to improve through ongoing feedback, updated support section tools, and enhanced response systems.

Though chat support rating and client satisfaction rating scores vary, Kraken remains one of the more reliable exchanges for accessible, round-the-clock help.

What Are Real Users Saying About Kraken?

I always look beyond my own experience when evaluating a platform, and Kraken generally scores well among the crypto community.

What is Common Praise from the Community?

Most long-time users praise Kraken’s security, regulatory focus, and staking options. I’ve seen it mentioned time and again as the “safe bet” for serious traders. I’d agree with that. It’s not flashy, but it works—especially when markets are volatile.

What Common Criticisms Do I Need to Be Aware Of?

The main gripes I’ve heard are:

- The fee structure can be confusing, especially for new users.

- Customer support isn’t always fast.

- The interface, while powerful, can feel outdated compared to other apps.

That said, I’d rather have function over form, and that’s where Kraken wins for me.

How Does Kraken Compare to Other Platforms?

Based on my firsthand experience, Kraken holds its own against the major players in the crypto space. Here’s a quick breakdown:

Should You Use Kraken as Your Main Crypto Exchange?

If you’re serious about crypto, whether you’re a long-term investor, active trader, or someone who values security, Kraken is worth considering as your main exchange. It’s the one I trust when I’m making bigger moves or staking assets I plan to hold for months.

Kraken is best suited for those who prioritise regulatory compliance, low trading fees, and a stable, secure platform. I personally lean on this platform when I don’t want to worry about sudden outages or questionable listing practices.

That said, it’s not for everyone. If you prefer social trading, experimenting with DeFi integrations, or hunting for the absolute lowest-cost altcoin trades, you might find more flexibility on other platforms. But if you want reliability and peace of mind, Kraken’s hard to beat.

What does the future look like for Kraken?

Looking ahead, Kraken is positioning itself for major growth and expansion, with global ambitions through Kraken International and a focus on regulatory licenses. Their recent move to acquire NinjaTrader signals a push into multi-asset trading, blending crypto with traditional markets.

Financially, Kraken saw a 19% revenue boost in Q1 2025, with new tools like FX perpetuals and desktop enhancements featured on its new features page. Ahead of a possible initial public offering (IPO) in 2026, Kraken is reportedly preparing a significant funding round.

Meanwhile, regular audits and enhanced customer protections—like Proof of Reserves and stricter expiry times—are strengthening trust. Kraken’s strategic moves suggest a strong trajectory toward becoming a full-spectrum financial platform.

Final Thoughts on Kraken

For me, Kraken remains one of the most dependable crypto exchanges. It’s not the flashiest, but it nails the fundamentals: security, transparency, and low fees.

If you haven’t tried it yet, I recommend starting small—maybe explore a few trades or try their staking features. And definitely check out Kraken Learn if you’re brushing up on crypto basics.

FAQs

Yes, Kraken is considered one of the safest crypto exchanges globally. It uses advanced security features like cold storage, 2FA, and address whitelisting, and it’s regulated by FinCEN, the FCA, and AUSTRAC.

Fees on Kraken Pro start at 0.16% for makers and 0.26% for takers, decreasing with higher trading volumes. Instant Buy is more convenient but costs around 1.5% per trade.

Yes, you can stake over 20 cryptocurrencies on Kraken, including ETH, ADA, and DOT. Payouts are regular, and you can often choose between flexible and bonded (locked) staking.

Kraken offers a simplified interface for new users, but it’s more geared toward intermediate and advanced traders. If you’re just getting started, Kraken Learn is a great place to build confidence.

Yes, Kraken offers margin trading (up to 5x leverage) and futures trading for select users. Availability may vary depending on your location and regulatory rules.

References

- Kraken’s Internal Protections – Security Protocols

- Kraken’s Official breakdown of costs – Fee Structure

- Kraken Blog – Kraken awarded the Finder 2025 Awards

- Kraken – Staking Options

- Reddit Discussion – Real User Feedback

Trade With Kraken Today

- Industry Leading Security

- Advanced Trading Tools

- Global Regulation and Transparency

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.